15 October 2024

This update releases new estimates of the purchase value of goods imported to St Helena during the 2023/24 financial year. The detailed data tables used to prepare this release can be downloaded here.

Total value of goods imported

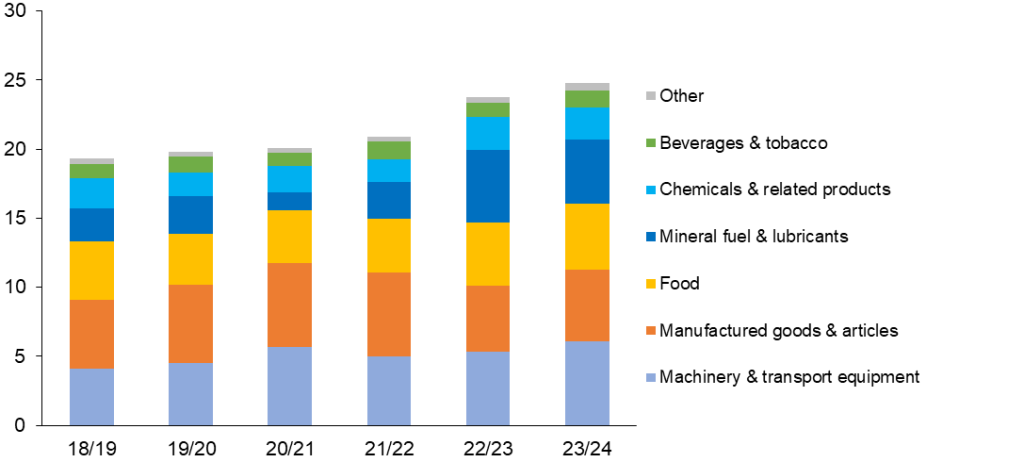

The total value of goods imported to St Helena during the 2023/24 financial year is estimated to be £24.8 million, an increase of £1.0 million compared to the previous year, or 4.3%.

Chart 1. Total value of goods imported to St Helena, 2018/19 to 2023/24, £ millions, current prices (i.e. unadjusted for inflation)

Note that the value of goods is ‘free on board’, which means that it excludes freight and insurance charges. Value-added taxes, sales taxes and other fees paid by importers are also excluded, since these statistics are compiled from declarations made by importers to the St Helena Customs authorities, which do not require these additional fees to be included. It is also not adjusted for inflation; a common term for this is that the valuation is in ‘current prices’.

Type of goods imported

Goods imported to St Helena predominantly fall into one of four major groups: machinery and transport equipment, manufactured goods and articles, food, and mineral fuel and lubricants. Diesel fuel, which is used in St Helena’s electricity power station, is the largest single item each year, typically arriving by fuel tanker in consignments every quarter. In 2023/24 the value of imported fuel continues to be higher than in previous years, following the global increase in price resulting from the invasion of Ukraine by Russia in 2022.

Chart 2. Imports of goods by commodity group, 2018/19 to 2023/24, £ millions, current prices (i.e. unadjusted for inflation)

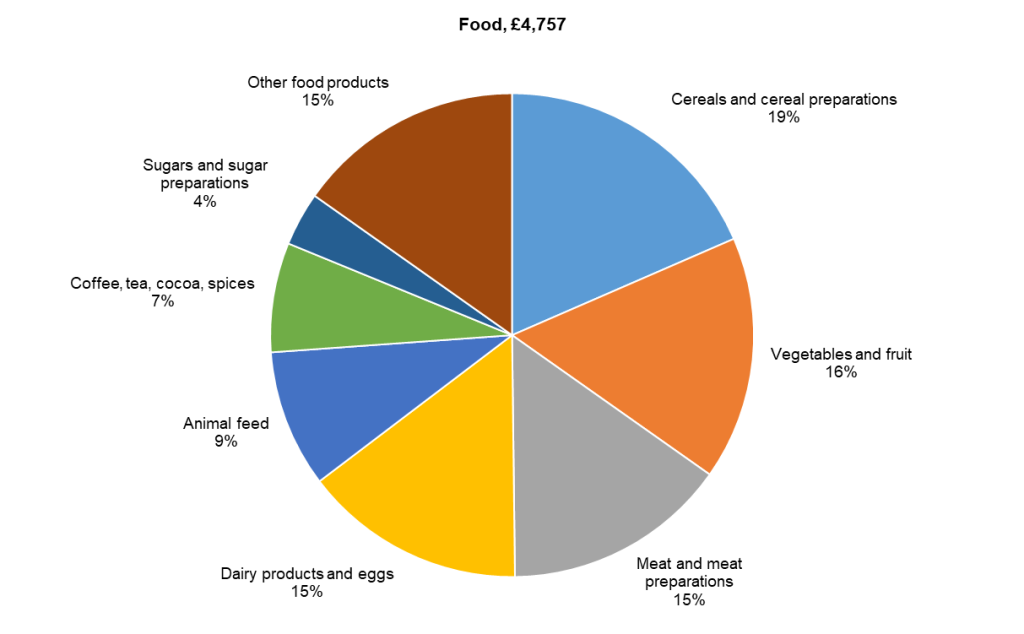

Imports of food, beverages and tobacco

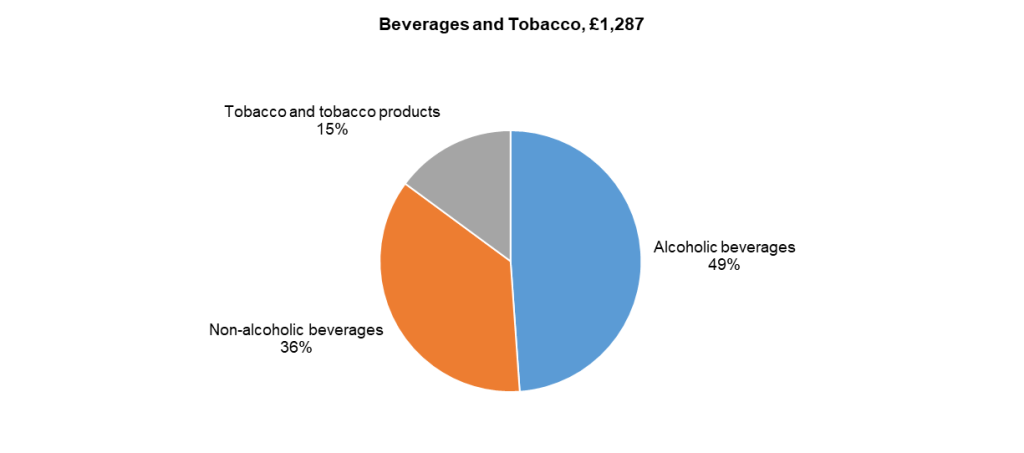

Food was the third largest group of commodity imports in 2023/24, with a purchase value of £4.8 million. Within the food grouping, cereals and cereal preparations was the largest sub-group (including items such as flour and rice), vegetables and fruit the second largest, and meat and meat preparations the third largest. The purchase value of beverages and tobacco imported was around a quarter of the value of food (£1.3 million); within that group alcoholic beverages made up around half of all imports.

Chart 3. Imports of food, 2023/24, £ thousands

Chart 4. Imports of beverages and tobacco, 2023/24, £ thousands

Country of purchase of imported goods

Most goods imported to St Helena are purchased in the United Kingdom or South Africa, reflecting the close ties between St Helena and the UK, and the historical cargo shipping routes between Cape Town in South Africa and Jamestown in St Helena. Historically, St Helenians tend to spend roughly the same in the UK and South Africa on imported goods, although slightly more has been spent in South Africa in the last three years than in the UK; this may reflect the relative weakness of the Rand compared to the Pound, making South African goods cheaper to purchase. Imports from other countries were mostly mineral fuel (diesel and petrol).

Chart 5. Imports of goods by recorded country of purchase, 2018/19 to 2023/24, £ millions, current prices (i.e. unadjusted for inflation)

Methodology

Concepts and definitions: The compilation methodology for international trade statistics on St Helena uses the guidelines published by the United Nations Statistics Division. Generally, imports and exports are transactions involving the exchange of goods or services between residents and non-residents of St Helena. For goods, imports and exports are usually recorded whenever a commodity crosses St Helena’s boundaries, typically a border entry point, or a ‘bonded’ warehouse (a place where goods liable to import taxes are stored until those taxes are paid). For the purpose of St Helena’s import statistics, the date of customs duty assessment is usually taken to be a reasonable estimate of the date at which the commodity has effectively crossed the border. Since goods are counted as imported when they enter the domestic economy, goods imported into bonded warehouses are only counted when they are released from bond. Goods imported after being temporarily exported for repair are also not included. Similarly, machinery imported on a temporary basis, for example to support construction products, is not included, if it can be identified. This update focuses on the imports of goods but it should be noted that St Helena’s trade with other countries also includes imports and exports of services. Imports of services include medical treatment and training programmes abroad, communications services, and services delivered by persons visiting the Island but who do not live on St Helena. St Helena’s service exports include spending on St Helena by tourists and short-term visitors; estimates of this non-resident spending on St Helena are available in the detailed data file, here.

Data source: Statistics on the imports of goods are derived primarily from the administrative records resulting from the Customs process, particularly the legal requirement for a declaration to be made to the Customs authorities whenever goods are imported or exported. These declarations are stored in a computer system called ASYCUDA, managed by the Customs Office. Although the Statistics Office conducts a number of consistency checks to identify and correct valuation and classification errors, the data quality of statistics on international trade depends on the quality of information entered into the ASYCUDA system by importers and by Customs officials. The quality of the information collected by the Customs Office on the quantities of commodities imported does not currently permit the calculation of trade statistics on volumes or quantities.

Valuation method: Values are reported in ‘current’ prices, that is, the value recorded at the time of the customs transaction, without any adjustment for price inflation (i.e. the changes in prices of commodities over time). On St Helena, the value recorded by importers for the assessment of import taxes and duties is ‘free-on-board’ (or FOB), rather than inclusive of ‘cost, insurance and freight’ (or CIF); import statistics are therefore also based on the FOB valuation of goods. This means that St Helena’s import statistics are based on the invoice value paid by the importer in the country of purchase, and they do not include the costs of shipment, or any duties or taxes paid in that country. Goods purchased in foreign currencies are valued in Pounds based on the exchange rate used for the Customs transaction, rather than the exchange rate used by the importer when they purchased the goods. If the rate used for the Customs transaction is not known, the average monthy ‘spot’ rate published by the Bank of England is used.

Classification of commodities: Commodities are classified by importers on their customs declarations using an eight digit tariff code, which is based on the international six digit ‘Harmonised System’ classification maintained by the World Customs Organisation. In this report, and for the presentation of St Helena’s trade statistics generally, the Standard International Trade Classification is also used; this was developed for analytical purposes by the United Nations Statistics Division, while the Harmonised System is primarily designed for the administration of Customs systems. There are ‘correspondence tables’ between these two classification systems maintained by the United Nations, which enables St Helena’s trade statistics to be analysed and presented using either classification.

Frequency: The trade statistics in this update are presented by financial year, and the Statistics Office currently analyses the ASYCUDA database every year. However, data are computed by quarter, which can allow calculation of trade statistics by calendar year, or by quarter if required. Any analysis of quarterly import statistics should be made with care, however, since they can be affected by the timing of cargo shipments and other issues.