Register a Company

You may wish to start a company to do business in St Helena. St Helena’s company registry service can be accessed online. The law on registration of companies and related issues is contained in the Companies Ordinance, 2004. You don’t need to have a company to be in business, but there are some circumstances where it can be very helpful. The two things to bear in mind are that a company is a legal person which is quite separate from the individuals who own or manage it, and companies incorporated (created) in St Helena will have limited liability for their members.

The Company Registry Policy was endorsed in 2020 and can be found here.

An application and information provided to the Companies Registry should normally be on a form provided for the purpose. The following forms are available on request from the Companies Registry or may be downloaded from this site. Forms should be submitted to Company Registrar Yvonne Williams yvonne.williams@sainthelena.gov.sh, and Company Administrator Amelia Gough amelia.gough@sainthelena.gov.sh.

Form no.

- Application for registration of a company

1A. Registered office of a foreign company - Details of company officer on initial registration

- List of members (shareholders)

- Appointment of company officer

- Notice of change in the details of a company officer

- Notice of change of company address

- Application for reservation of a corporate name

- Notice of change of name

- Cessation of appointment of company officer

- Notice of change in share capital

- Change in authority of company officer

- Notification of a charge against the assets of a registered company

- Notification of the discharge of a charge

Articles of incorporation must be delivered with forms 1, 2 and 3. The precise content of the articles is for the members of the company to decide, but they must contain certain information required either by the Companies Ordinance or the Regulations. Section 10 of the Companies Ordinance provides the requirements for the Articles of Incorporation.

As per section 128, 130 and 133 of the Companies Ordinance, the directors of a public company must complete an annual financial statement and provide this to the Company Registrar.

The fees are as follows:

| DESCRIPTION | FEE | |

| 1. | For Incorporation or Registration: | |

| 1a | Incorporation of a private company specified under section 184 of the Companies Ordinance, or a company limited by guarantee | £80.50 |

| 1b | Incorporation of any other company | £741.00 |

| 1c | Registration of an overseas company | £375.60 |

| 2. | Reservation of a name | |

| 2a | Any company | £49.40 |

| 3. | On delivery of documents to the Registrar | |

| 3a | Amendment to Articles (including change of name but excluding an amendment made pursuant to section 184(4)) | £80.50 |

| 3b | Amendment to Articles made pursuant to section 184(4) | £741.00 |

| 3c | Annual return (any company) | £21.60 |

| 3d | Financial Statement (specified private company or company limited by guarantee) | Nil |

| 3e | Financial Statement (where 3d does not apply) | £80.50 |

| 3f | Any other document | £16.10 |

| 4. | Searches and copy documents | |

| 4a | To view information at a computer terminal in the Registrar’s office | £5.35for each 20 minutes or part thereof |

| 4b | To print information from a computer in the Registrar’s office | £1.65 per A4 page (single-sided) |

| 4c | To view summary information via a website maintained by the Registrar | Nil |

| 4d | To access copies of registered documents via a website maintained by the Registrar | £10.75 per document |

| 4e | Certification by the Registrar of a copy of any document held by the Registrar | £16.10 |

| 4f | Issue of a certificate by the Registrar regarding any information held by the Registrar (excluding a certificate of registration or incorporation issued at the time of registration or incorporation, or a certificate of actual or intended dissolution) | £37.55. |

Tax rates are as follows:

- The Corporation Income Tax rate is 25% of profit from income earned, accrued or derived in or from St Helena. Except for income derived from the following sectors in St Helena, which is subject to a lower 15% tax rate; production by the taxpayer of goods or services in the course of carrying on— (i) exportation of goods and services; (ii) fishing and fish processing; (iii) cultivation of honey; (iv) growing and roasting of local coffee; (v) farming and butchering of meat; (vi) farming of vegetables, legumes, nuts or fruit or the processing of locally grown produce; (vii) distilling or brewing of liquor, wine or beer; (viii) production of traditional craftwork, or jewellery using predominantly locally sourced inputs (recycled, grown, or mined in St Helena); (ix) production of upholstery or clothing.

- The proposal in the Company Registry Policy draft out for consultation is to deem 20% of income derived globally as income earned, accrued or derived in or from St Helena and taxed at the standard 25% rate.

- The tax rate on dividends is 8%.

- There is no specific VAT in St Helena.

More information can be found on the Income Tax webpage or the Income Tax Ordinance.

Register and Licence an Earth Station

You may wish to licence a Permanent Earth Station or Receive Only Earth Station in St Helena. The application form can be found here.

On 28 April 2020, Executive Council endorsed the Policy Statement on the Licensing of Permanent Earth Stations and Receive Only Earth Stations.

See this Policy Statement in full.

The policy is implemented by the St Helena Registrar who may be contacted via email to karen.yon@sainthelena.gov.sh.

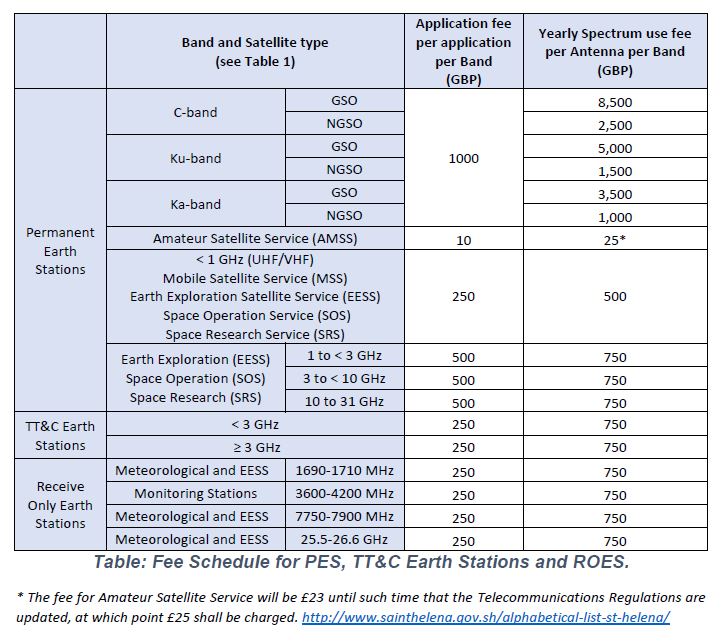

Fee Schedule for the Licensing of Permanent Earth Stations, Telemetry, Tracking and Command Earth Stations and Receive Only Earth Stations

Register a Ship

The St Helena Merchant Shipping Policy sets out the criteria for the registration of fishing vessels, commercial vessels, yachts and pleasure vessels in St Helena. The policy is set by the Executive Council and implemented by the St Helena Registrar of Shipping who may be contacted at karen.yon@sainthelena.gov.sh.

Download the Merchant Shipping Policy in full.

Vessel Registration Fees

| Standard fees | |

| Initial Registry/Registry Renewal/Transfer of Port to St. Helena/Registry Anew: | |

| ~Up to 150GRT Commercial or over 150GT Pleasure owned by persons described in sections (a) (b) or (c) of the Registration of Fishing Vessels, Commercial Vessels, Yachts and Pleasure Vessels Policy Statement | £400 |

| ~Under 100GRT Commercial or under 150GT Pleasure owned by persons described in sections (a) (b) or (c) of the Registration of Fishing Vessels, Commercial Vessels, Yachts and Pleasure Vessels Policy Statement; | £250 |

| ~Small Commercial or any Pleasure owned by persons described in sections (a) (b) or (c) of the Registration of Fishing Vessels, Commercial Vessels, Yachts and Pleasure Vessels Policy Statement; | £50 |

| ~Up to 150GRT Commercial or any Pleasure Vessel owned by persons described in sections (d) or (e) of the Registration of Fishing Vessels, Commercial Vessels, Yachts and Pleasure Vessels Policy Statement; | £600 |

| Provisional registration | £200 |

| Transfer of Ownership by Bill of Sale | £120 |

| Transfer of Ownership by Transmission on Death of owner | £120 |

| Registration of priority notice by intending mortgagee | £50 |

| Renewal of priority notice by intending mortgagee | £45 |

| Registration of Mortgage | £120 |

| Transfer or Transmission of Mortgage | £120 |

| Discharge of Mortgage | £120 |

| Renewal of Registration | £100 |

| Change in particulars, including change of Engine, Authorised Officer | £50 |

| and change of Representative Person | £50 |

| Change of Vessel name | £50 |

| Issue of duplicate certificate | £50 |

| Transcript of a Register | £50 |

| Request for Closure by owner | £50 |

| Transcript of a Closed Register | £50 |

| Transcript of a Register at other than current date | £50 |

| Transfer of Port of Registry from St Helena, including transcript & closure | £80 |

| Inspecting a Register Book | £15 |

| Certified Copy of Document | £5 |