17 December 2018

The eleventh Statistical Bulletin of 2018 releases new estimates of gross incomes from employment for the 2017/18 financial year, together with small revisions to estimates for previous years. The data in this Bulletin are derived from records maintained by the Income Tax Office primarily from the Pay-As-You-Earn (PAYE) system. The methodology used is consistent with previous estimates for 2011/12 to 2016/17. An improvement in this release is that most of the average income estimates are adjusted for the impact of price inflation, using constant 2017/18 prices, rather that the nominal figures used in previous Bulletins.

When price inflation is taken into account, the average income on St Helena fell slightly in 2017/18 compared to the previous year by 0.7%. However, the lowest earners and female workers have experienced a small average increase in income, whilst the highest income earners and male workers have experienced a small average decrease in income.

The pdf version of the full Bulletin can be found here.

Average gross employee income

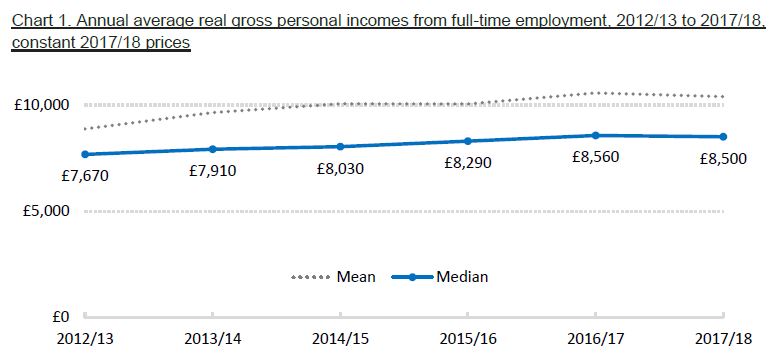

The average annual gross income from full-time employment on St Helena in 2017/18, measured using the median, was £8,500 per employee. This is a nominal increase of 3.3% compared to the previous year. But since retail prices rose faster than this, by 4.1% in 2017/18 on average, the average gross income from employment fell slightly in real terms by 0.7% when inflation is taken into account. This is the first fall in the real levels of average incomes from employment for at least the last five years (Chart 1), when the annual “real” rise in average incomes from employment was 2.7% on average. Despite the slight fall in average income compared to 2016/17, the real average income for 2017/18 was still 2.5% greater than the average income for the year 2015/16.

Note that the median is the usual measure of average incomes: it is the level at which half of those above it earn more, and half earn less – so for 2017/18 half of gross employment incomes were less than £8,500, and half were higher. The median is used because it is less sensitive to small numbers of high incomes than the mean; the mean tends to overstate the average for this reason (Chart 1).

Chart 2 shows the upper and lower quartiles; the lower quartile is the point at which a quarter of incomes are lower, and the upper quartile is the point at which a quarter if incomes are higher. Half of all incomes from employment lie between the lower and upper quartiles, so for 2017/18 half of all full-time employees earned between £6,700 and £11,680. This chart also shows incomes adjusted for inflation; it is interesting to note that the upper quartile for 2017/18 is lower, in real terms, than the upper quartile in 2014/15, whilst the lower quartile is at the highest for six years. This shows that the lowest incomes have increased, whilst the highest incomes have reduced.

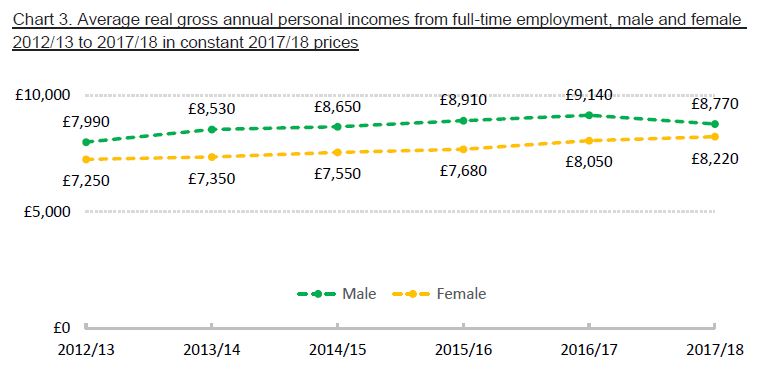

Chart 3 shows real incomes from employment broken down by male and female. From 2012/13 to 2017/18, male incomes were higher than female on average. The gap between the two grew in 2013/14, remained the same until 2016/17, but it narrowed in 2016/17 as male incomes fell faster than the average while female real incomes continued to rise. This may be the effect of completion of the construction of the Airport, since workers were predominantly male and many of them left St Helena or found alternative employment during 2016/17 and 2017/18.

As in previous statistical releases on income, these estimates measure pre-tax (gross) incomes of the persons in full-time regular employment on St Helena above an analysis threshold. They exclude company and self-employment incomes, incomes of Technical Cooperation Officers, and investment income. For each year, the analysis threshold is set at a level around the single-person rate of the Minimum Income Standard (less housing rent), a measure of poverty – this helps eliminate part-time incomes, incomes derived purely from benefits, and incomes that are under reported. Unless otherwise stated, all estimates of personal incomes in this bulletin use these thresholds. All annual estimates are rounded to the nearest 10.

Distribution of incomes from employment

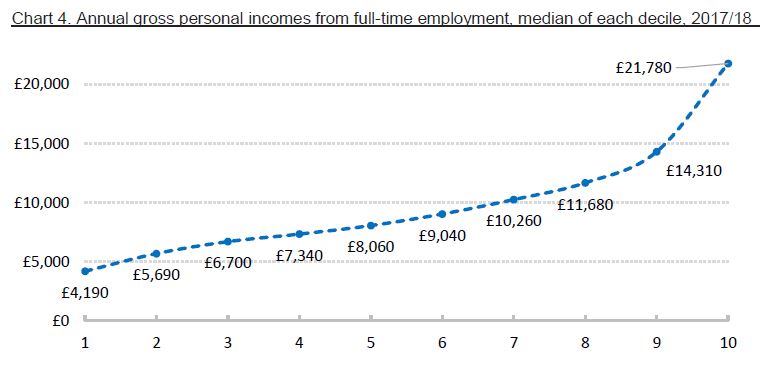

Chart 4 illustrates the distribution of personal incomes from full-time employment in 2017/18. As in 2016/17, there is less than £4,000 between the medians of the first five deciles – the half of the population with the lowest incomes, and, in contrast, the medians of the half of the population with the highest incomes have a much broader spread of over £12,000.

The minimum wage and the income tax threshold

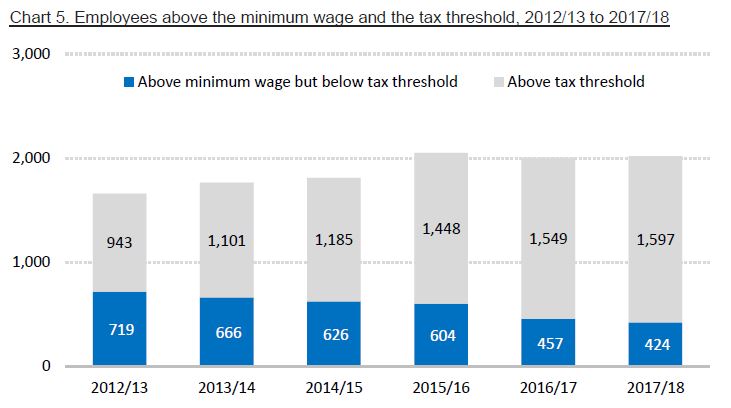

St Helena operates a minimum wage policy, and St Helena’s income tax system also operates a minimum threshold before any tax is due; this taxable income threshold remained constant at £7,000 per person per year for the financial years 2011/12 to 2016/17, although the minimum wage has changed: from £2.30 to £2.60 an hour in July 2015, then from £2.60 to £2.95 an hour in July 2017, and from £2.95 to £3.05 an hour in August 2018 for employees over the age of 18. Chart 5 shows the number of persons earning income from full-time employment that were above the minimum wage and the income tax threshold.

The number of employees above the fixed income tax threshold of £7,000 has been increasing each year; for instance there were 660 extra people paying income tax as a result of employment income in 2017/18 compared to 2012/13. The total number of employees above the minimum wage has been fairly stable (around 2,000) over the last three years.

Get the data

The complete set of statistics on average gross incomes from employment from 2012/13 to 2017/18 are available at www.sainthelena.gov.sh/statistics/data.

Methodology

Data source. Statistics on incomes on St Helena are derived from a computerised database maintained by the Income Tax Office. This captures information about all income-earners whose details are submitted through the Pay-As-You-Earn (PAYE) system and through individual and corporate tax returns. There are some limitations when using this database as a source for estimating incomes; for example, informal income earned may not be declared, and it is difficult to distinguish full-time and part-time workers.

Gross income from employment. The primary analysis in this Bulletin uses average gross incomes from full-time employment. Income from investments and from self-employment is excluded. Incomes are gross, i.e. before any tax is deducted, and all estimates are rounded to the nearest 10.

Median. The median is a measure of the average value of a set of numbers. It is the ‘middle number’ in a ranked list, the value at which exactly half the population has a smaller value and half has a higher value. It is preferred to the mean when estimating average incomes or wages, since it is less easily ‘skewed’ by individuals with relatively large incomes.

Mean. The mean is a measure of the average value of a set of numbers; it is derived by adding all the numbers together, and dividing by the number of values in the dataset. While it is the most common measure of the average for many applications, it can produce misleading results for estimating average incomes because it can be biased by small numbers of relatively high incomes.

Inflation adjustment. An important improvement in this release is that most of the average income estimates are adjusted for the impact of price inflation, using St Helena’s Retail Price Index. This is done by quoting “real” estimates in constant 2017/18 prices, rather that the nominal figures used in previous releases. This makes comparisons over time more meaningful, since any change up or down shows whether a person has more or less purchasing power. For example, the average nominal gross income for 2012/13 was £6,720 per year. But prices were not the same in 2017/18 compared to 2012/13 – they increased, on the whole. Using the Retail Price Index to make the calculation, an employee would need to have earned £7,770 a year to buy the same amount of goods and services in 2017/18 that they could buy in 2012/13 with £6,720. So £7,770 is the average gross income in 2012/13, in 2017/18 prices.

Analysis threshold. Statistics on average gross incomes use a lower bound threshold to ensure that part-time or under-reported incomes, and incomes derived entirely from social benefits rather than employment, are excluded from the analysis as far as possible. The threshold is set slightly above the Minimum Income Standard level (less housing rent) for a single adult, a measure of poverty.

Technical Cooperation Officers. Technical Cooperation Officers are persons employed by the Government of St Helena following international recruitment as a result of limited particular labour availability on St Helena. They are employed for a fixed period of time on internationally competitive pay scales and terms and conditions which differ from those recruited locally on St Helena. As such, their incomes are not considered typical and so are excluded from the main statistics on incomes.