15 October 2025

Latest index value and inflation rates for Q3 2025

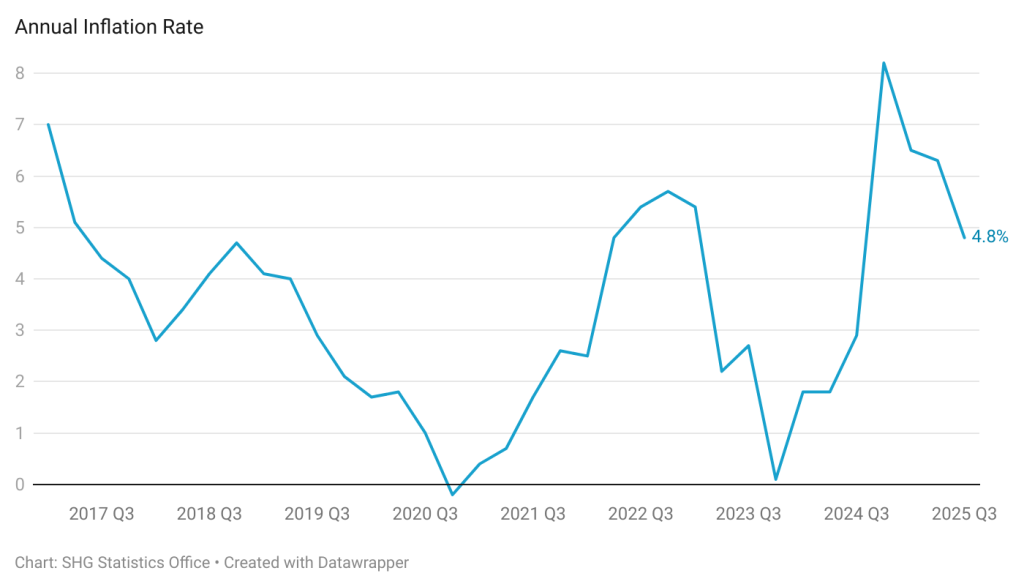

The latest estimate of the Consumer Price Index (CPI) has been released by the St Helena Statistics Office, for the third quarter of 2025 (Q3 2025). The CPI has been measured at 104.8, an increase of 1.2% on the previous quarter (Q2 2025) and a 4.8% increase compared to a year ago (Q3 2024). This annual inflation rate of 4.8% is a drop in the rate by 1.5 percentage points compared to the rate measured in Q2 2025, which was 6.3%.

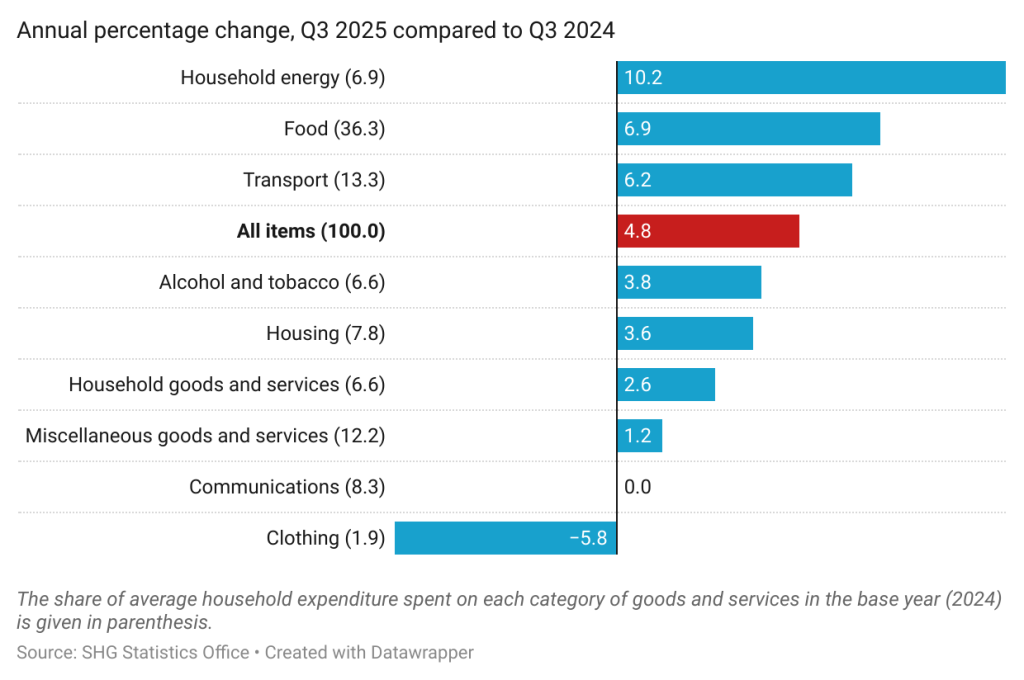

Price changes over the last year

All broad groups of items in the Index saw their prices rise, on average, compared to a year ago, apart from the Clothing category. The highest average annual increase was in Household Energy (10.2%), the result of changes to the electricity tariff implemented on 1 July 2025. There was an average annual increase in Food prices of 6.9%, which is similar to the level of annual food price inflation measured in Q2, which included the increase in the price of bread and meat in Q4 2024. Transport prices also increased on average by 6.2%, with increases in items that represent the cost of passenger road transport. The annual rate of price inflation for Communications was previously measured at 18.4% in Q2, but this is now zero because it has been more that a year since the revised tariffs for land line telephones and mobile phones took effect.

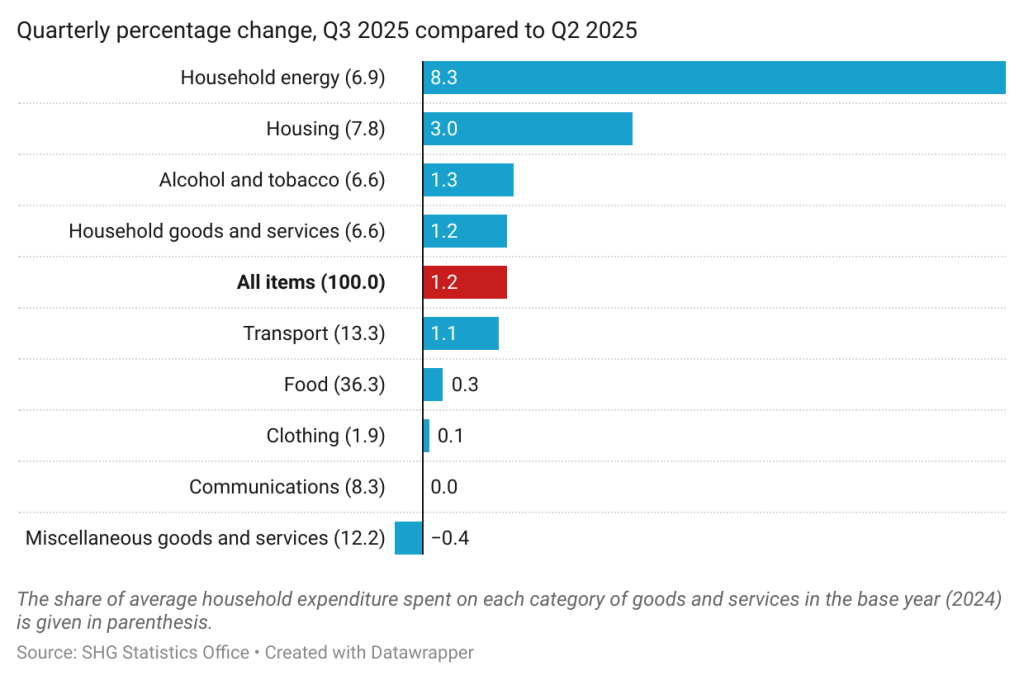

Price changes over the last quarter

The quarterly change in the CPI was 1.2%, comparing Q3 2025 to Q2 2025. All categories experienced average increases since the last quarter, apart from Miscellaneous Goods and Services (-1.4%). Household Energy and Housing saw the largest increase between the quarters, a result of the changes to the tariffs for both water and electricity introduced at the beginning of Q3 2025 by Connect St Helena Ltd. Alcohol and Tobacco (1.3%) and Household Goods and Services (1.2%) also went up on average, due to changes in the price of tobacco-based products, and increases in the minimum wage respectively.

Price changes in both the UK and South Africa have a strong impact on prices on St Helena, since the majority of goods imported are purchased in those two countries. In the UK, the annual price inflation rate (using the Consumer Price Index) was 3.8% for August 2025, unchanged from July. In South Africa, the Consumer Price Index was 3.3% for August, down from 3.5% in July 2025. This year, between Q3 2024 and Q3 2025, price changes in locally-provided services has also had a significant impact on the overall inflation rate, including changes in electricity and water prices, and increases to the minimum wage. In this quarter, it is notable that previous changes to the prices of telecommunication services are no longer applying upward pressure on the annual inflation rate, since it is now a full year since the changes were made.

Methodology

Rebasing the Index

The Index was rebased in the third quarter of 2024, following the 2023 Household Expenditure Survey (HES) and subsequent analysis by the Statistics Office. The HES reviewed the composition of the average ‘shopping basket’ of goods and services purchased by households on St Helena, to make sure it reflects current spending habits. The Statistics Office has also reviewed the items that are used to represent each category of spending in the basket, to make sure they are also up to date and relevant. The rebased Index includes 205 categories of expenditure, within nine broader groupings; these broader groupings are unchanged from the previous Index. Within the broad groupings, the detailed categories of expenditure have been adjusted slightly to better align with international guidelines, and in particular they now only include expenditure related to household consumption, and not all expenditures. This has also made a change to the terminology necessary: the Index has been renamed the Consumer Price Index (CPI), rather than the Retail Price Index (RPI).

What is price inflation and how is it measured?

Price inflation is the change in the average prices of goods and services over time. The rate of price inflation is calculated from the change in the CPI, which is the official measure of the average change in the prices of goods and services paid by consumers. The CPI is estimated each quarter, i.e. once every three months, and the rate of price inflation is usually quoted on an annual basis; that is, comparing price changes over a 12-month period. Prices and the CPI tend to go up, but they can occasionally go down – which is known as price deflation.

The CPI is a statistical measure of the change in consumer prices on St Helena; an increase in the CPI means that, on average, prices have gone up since the last time they were measured, and a decrease in the CPI means that, on average, prices have fallen. The annual change in the CPI is called the annual inflation rate, and is the usual measure of the change in prices in an economy. The CPI is an average measure: if it goes up, it does not mean that all prices have gone up, and similarly, if it goes down, it does not mean that all prices have fallen.

Why do we measure inflation?

An accurate measure of price inflation helps understand the extent and nature of the impact of price changes on the government, businesses, households and individuals. Inflation rates are often used in budgeting and accounting processes so that costs can be adjusted for the effect of price changes.

How is the CPI calculated?

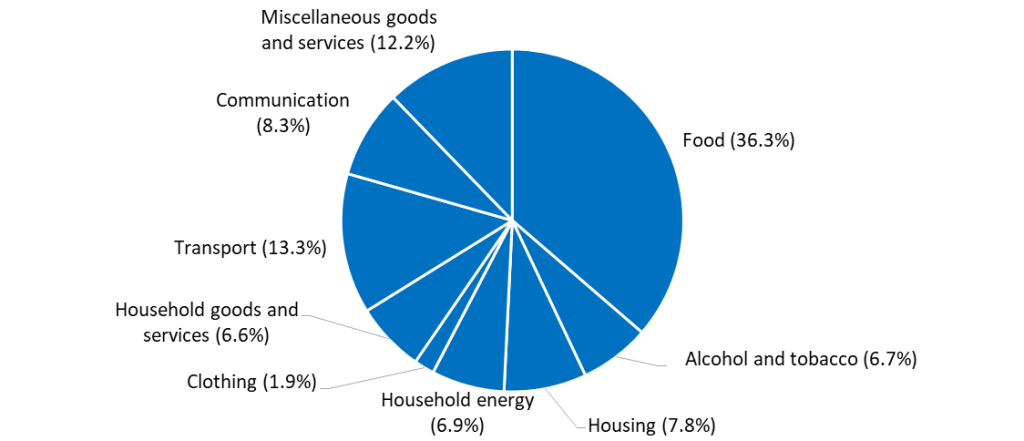

The basis for the CPI is the average weekly cost of goods and services purchased by households on St Helena for consumption, sometimes called the CPI ‘shopping basket’. Items which households purchase more of, such as food, have the biggest share of the CPI basket. The current CPI uses a basket from the latest Household Expenditure Survey in 2023; prices representing the groups of items in the basket are collected every quarter, and the price of the total basket is compared to the price in the baseline period, the third quarter of 2024. By convention, the value of the basket in the baseline period is scaled to 100, and the CPI values are quoted in relation to that baseline. For example, a CPI value of 120 means that average prices have increased by 20 per cent compared to those recorded in the baseline period.

Composition of average household weekly expenditure (Q3 2024 CPI ‘Shopping Basket’)

What happens when items are not available?

If an item of the ‘basket’ is not available then either the previous price will be carried forward from the previous quarter, or a suitable substitute item will be identified and an adjustment calculation made. Care is taken to ensure that this substitute item represents the item category and that it does not introduce error to the measurement of the CPI. An important principle is that price changes should reflect actual price increases and decreases, and not changes in the quality of items.

Where can I get the data?

For detailed tables of the CPI and annual inflation rates from 1994 onwards, please visit: https://www.sainthelena.gov.sh/st-helena/statistics/the-economy and download the ‘inflation’ data file. Other datasets, bulletins and reports are also available on our website at www.sainthelena.gov.sh/statistics.

Have more questions or comments?

Please get in touch. We are Neil Fantom, Statistical Commissioner, Kelly Clingham and Justine Joshua, Senior Statistical Assistants and Courtney O’Dean, Statistics Assistant. You can find us in person at the Statistics Office on the top floor of the Post Office, Jamestown. You can also contact us by telephone on our direct line through 22138. If calling from overseas, the international dialling code for St Helena is +290. Our general office e-mail address is statistics@sainthelena.gov.sh, or you can email team members directly (the format is firstname.lastname@sainthelena.gov.sh).