17 October 2023

Estimates of the Retail Price Index and price inflation rates have been calculated for the third quarter of 2023. The data released in this Bulletin can be downloaded in Excel format here, and a PDF version of this Bulletin can be downloaded here. More statistics on St Helena’s economy can be found here.

The Retail Price Index

The Retail Price Index (RPI) is a statistical measure of the change in retail prices on St Helena. An increase in the RPI means that, on average, prices have gone up since the last time they were measured, and a decrease in the RPI means that, on average, prices have fallen. It is important to understand that the RPI is an average measure: if it goes up, it does not mean that all prices have gone up, and similarly, if it goes down, it does not mean that all prices have fallen.

Latest index value and inflation rates

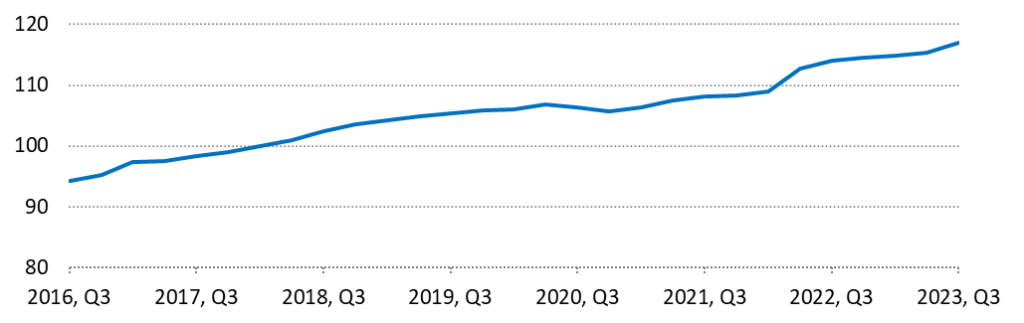

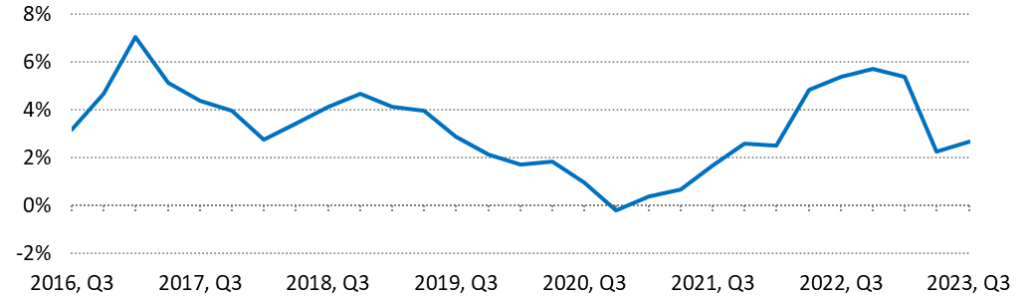

For the third quarter of 2023 the RPI has been measured at 117.0 (Chart 1). A year ago the RPI was 113.9, resulting in an annual inflation rate of 2.7%, comparing average prices in the third quarter of 2023 to the same time period in 2022. This is 0.5 percentage points higher than the previous annual inflation rate for Q2 2023, which was 2.2%, itself down from 5.4% in Q1 2023 (Chart 2).

Chart 1. Retail Price Index, Q3 2016 to Q3 2023

Chart 2. Annual inflation rate, Q3 2016 to Q3 2023

Price changes in the last year

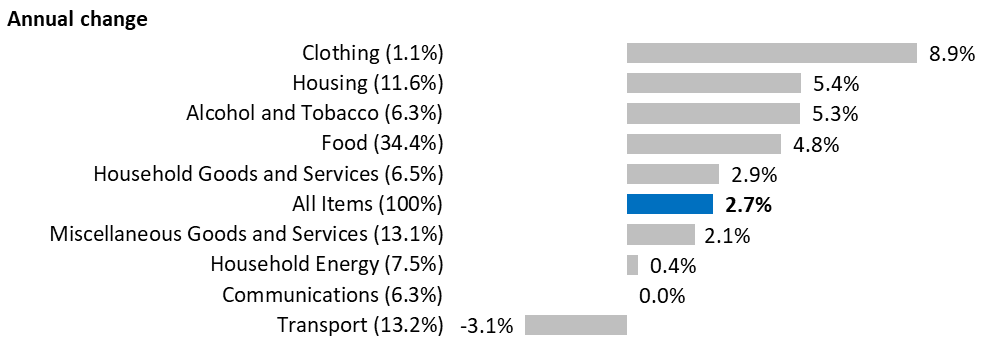

The index uses 203 representative items to measure price changes in nine different categories of household spending. Since a year ago, 85 items increased in price, 28 items decreased in price, and the price of 90 items remained unchanged. All categories within the index saw an increase over the past year (Chart 3), apart from Communications, which has remained unchanged, and Transport, which saw a decrease.

Average prices over the year in the Clothing and Housing categories rose the most, 8.9% and 5.4% respectively. Increases in the average prices of footwear contributed most to the increase in the Clothing category, but the impact of these price changes on the overall index is quite small due to the low weight of the overall category (1.1%). Within the Housing category, there were price increases in some building materials, and the prices for government-landlord housing rent were revised. The Food category rose by 4.8 % compared to the same period in 2022, contributing factors included price increases in some tinned goods and oil-based products.

The fall in the price of Petrol and Diesel over the past year resulted in the decrease in the Transport category. These two commodities have the highest weighting in their category and are also within the top 10 highest weighted commodities in the entire basket. During the year between Q3 2022 and Q3 2023, the price of Petrol fell by 9%, and the price of Diesel fell by 14%.

On October 1, the telecommunication service provider (Sure South Atlantic Limited) introduced a new tariff for broadband internet and mobile phone services, including lowered prices and improved data speeds and allowances. Since they occurred in October these changes are not incorporated in the Q3 2023 RPI, but they will be reflected in Q4, which is due for release in mid-January 2024. International standards for price indices require that they reflect changes in prices for the same level of services, which means that the Q4 2023 RPI is likely to record a large drop in the average price of telecommunication services: consumers can now purchase much better services for a lower price.

Chart 3. Annual price change by category, St Helena (Q3 2022 compared to Q3 2023)

Note: category weights are provided in parentheses; these indicate the extent to which different categories are represented in the overall index. Categories with higher weight have a greater contribution to the index than categories with lower weights.

Price changes in both the UK and South Africa have a strong impact on prices on St Helena, since the majority of goods imported to St Helena are purchased in those two countries. In August 2023, annual consumer price inflation in the UK was measured at 6.7% (UK Office for National Statistics), down from 6.8% in July, and in South Africa it was measured at 4.8% (Statistics South Africa), up from 4.7% in July. Changes in the value of the Rand compared to the Pound also have an effect on the price of goods purchased in South Africa; over the last twelve months the Pound has averaged around 22 Rand, which is stronger than it was in the previous 12 month period. The impact of this is to make goods bought in South Africa cheaper for St Helenian importers, potentially counteracting some of the effect of South African price inflation and any increases in transport costs.

Price changes in the last quarter

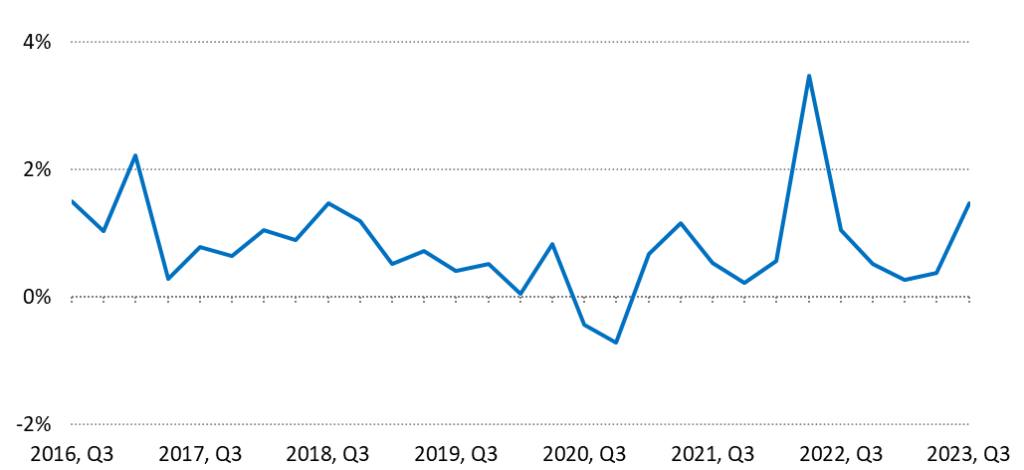

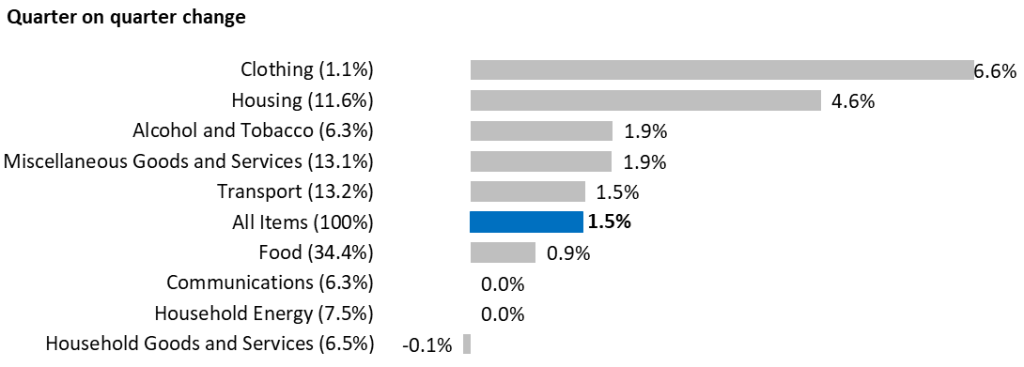

Shorter-term changes in prices can be measured by comparing the index with its value in the last quarter, three months ago (i.e. with Q2 2023). Charts 4 and 5 illustrate these quarterly inflation rates. They are often lower than the annual rates, since they measure price changes over a much shorter period. Between Q2 of 2023 and Q3 of 2023, average prices rose by 1.5%: in the RPI calculations, 40 prices rose, 11 prices fell, and 152 prices remained unchanged.

Chart 4. Quarterly inflation rate, Q3 2016 to Q3 2023

On average, prices of items representing Clothing rose the most over the quarter, 6.6%, although prices within this category can be quite volatile, and the weight of Clothing in the RPI is quite low, at 1.1%. Food rose by 0.9% compared to the previous quarter, with the two highest quarterly increases measured in representative items for fresh fruit and vegetables. The Household Goods and Services category saw the biggest fall in average prices over the quarter, a result of the reduction in price of some household cleaning items.

Chart 5. Quarterly price change by category, St Helena (Q2 2023 compared to Q3 2023)

Note: category weights are provided in parentheses; these indicate the extent to which different categories are represented in the overall index. Categories with higher weight have a greater contribution to the index than categories with lower weights.

Some Frequently Asked Questions

What is price inflation?

Price inflation is the change in the average prices of goods and services over time. The rate of price inflation is calculated from the change in the RPI, which is the official measure of the average change in the prices of goods and services paid by consumers. The RPI is estimated each quarter, i.e. once every three months, and the rate of price inflation is usually quoted on an annual basis; that is, comparing price changes over a 12-month period. Prices and the RPI tend to go up, but they can occasionally go down – which is known as price deflation.

Why do we measure inflation?

An accurate measure of price inflation helps understand the extent and nature of the impact of price changes on the government, businesses, households and individuals. Inflation rates are often used in budgeting and accounting processes so that costs can be adjusted for the effect of price changes.

How is the RPI calculated?

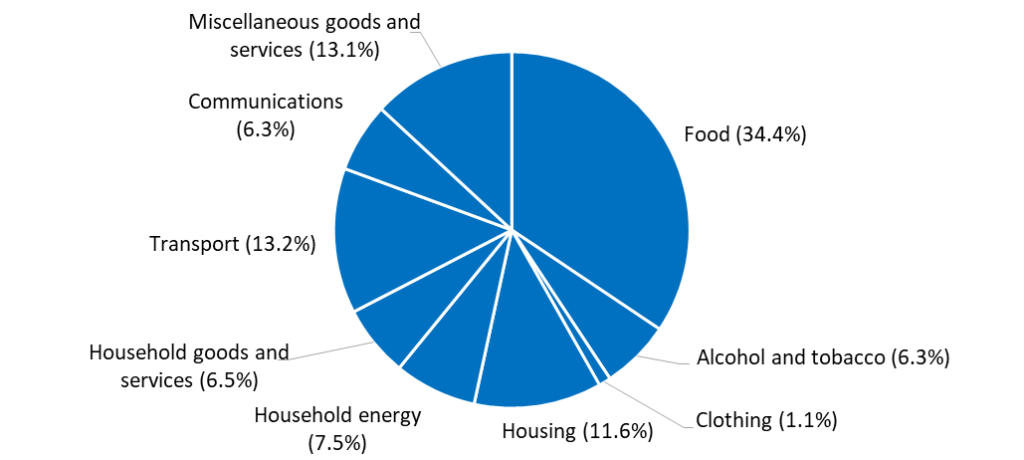

The basis for the RPI is the average weekly cost of goods and services purchased by households on St Helena, sometimes called the RPI ‘shopping basket’. Items which households purchase more of, such as food, have the biggest share of the RPI basket. The current RPI uses a basket from the latest Household Expenditure Survey in 2017; prices representing the groups of items in the basket are collected every quarter, and the price of the total basket is compared to the price in the baseline period, the first quarter of 2018. By convention, the value of the basket in the baseline period is scaled to 100, and the RPI values are quoted in relation to that baseline. For example, an RPI value of 120 means that average prices have increased by 20 per cent compared to those recorded in the baseline period.

Composition of average household weekly expenditure (Q1 2018 RPI ‘Shopping Basket’)

What happens when items are not available?

If an item of the ‘basket’ is not available then either the previous price will be carried forward from the previous quarter, or a suitable substitute item will be identified and an adjustment calculation made. Care is taken to ensure that this substitute item represents the item category and that it does not introduce error to the measurement of the RPI. An important principle is that price changes should reflect actual price increases and decreases, and not changes in the quality of items.

Have more questions or comments?

Please get in touch. We are Neil Fantom, Statistical Commissioner, Kelly Clingham and Justine Joshua, Senior Statistical Assistants and Courtney O’Dean, Statistics Assistant. You can find us in person at the Statistics Office on the top floor of the Post Office, Jamestown. You can also contact us by telephone on ourdirect line through 22138. If calling from overseas, the international dialling code for St Helena is +290. Our general office e-mail address is statistics@sainthelena.gov.sh, or you can email team members directly (the format is firstname.lastname@sainthelena.gov.sh).