8 August 2022

In order to soften the impacts of the rising cost of living, a number of policy changes were recently approved by Executive Council. These changes last through to 31 March 2023:

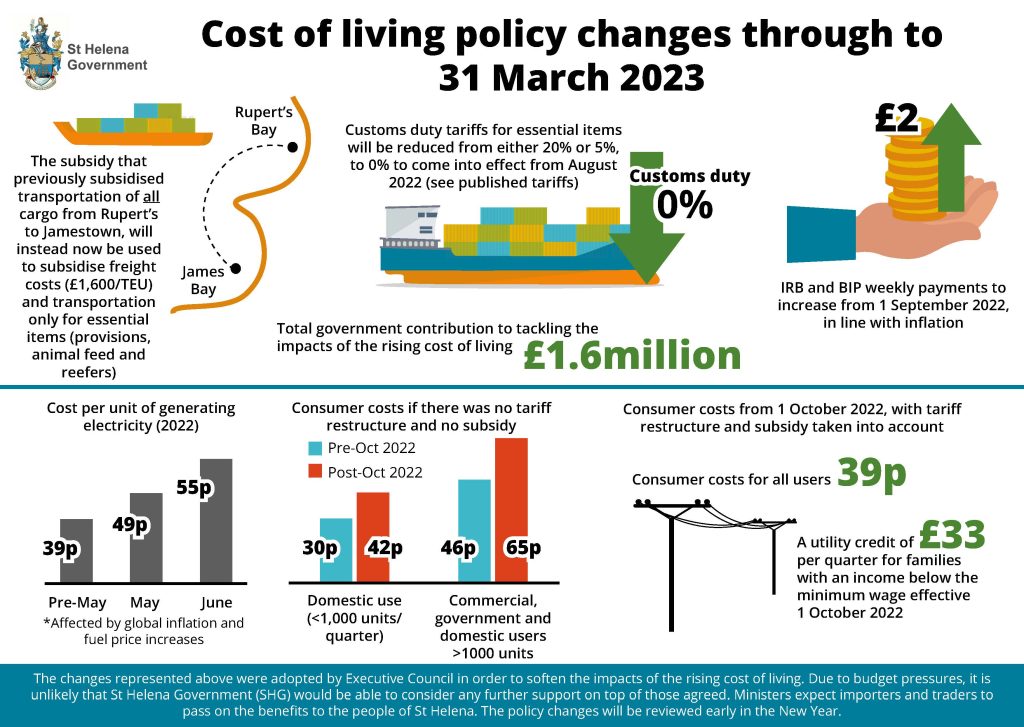

- Customs duty reduction: With effect from August 2022, customs duty tariffs for certain essential items will be reduced from either 5% or 20%, down to 0%, as reflected in the Customs & Excise (Amendment) Regulations 2022. These items include essentials such as basic foods, PPE, and items deemed most essential for low-income households.

- Freight-transport subsidy reallocation: The subsidy that previously covered transportation of all cargo from Rupert’s to James Bay, will instead now subsidise only the transportation of essential items (provisions, animal feed and reefers) as well as a contribution to freight costs (£1,600/TEU) on these items. This will take effect from voyage 55.

- IRB and BIP increases: From 1 September 2022, both Income Related Benefits (IRB) and Basic Island Pension (BIP) will increase by £2/week. This is in line with the 2021 inflation rate of 2.6%, and is reflected in the Social Security (Amendment) Regulations 2022. This will see weekly IRB rise from £73 to £75, and weekly BIP rise from £75.50 to £77.50.

- Utilities tariff restructure: A restructure of Connect Saint Helena Ltd’s utilities tariffs was endorsed, and an untargeted subsidy of £1.35m was allocated, to prevent the rising cost of fuel from causing a 40% increase to all consumer utilities costs. Between May and July 2022, the cost per unit for Connect to generate electricity rose 41%. Therefore, without intervention, consumer tariffs would have risen from 30p to 42p for domestic consumers (using 1,000 units/quarter or less), and from 46p to 65p for all other consumers. Instead, with intervention, all consumers from 1 October 2022 will pay 39p/unit. This proposed change in the tariff structure is still to be agreed by the Utilities Regulatory Authority.

- Lowest-income utilities credit: From 1 October 2022, eligible families with incomes below the minimum wage and who have less than £4,000 in savings may apply to receive a quarterly utilities credit of up to £33.

The above changes represent a £1.6milion government contribution to lessening the impacts of the rising cost of living – affected by global inflation and fuel price increases – on the people of St Helena.

Due to budget pressures, it is unlikely that St Helena Government (SHG) would be able to consider any support measures further to those listed above. Ministers expect importers and traders will pass on the benefits to the wider community.

These policy changes will be reviewed early in the New Year, prior to the 31 March 2023 expiry. A link to the Customs & Excise (Amendment) Regulations 2022 is available here: https://www.sainthelena.gov.sh/wp-content/uploads/2022/08/LN-16-Customs-and-Excise-Tariffs-and-ExemptionsAmendment-Regulations-2022.pdf

SHG

8 August 2022