This page provides details about the different methodologies used by the Statistics Office to estimate various key statistics.

- Inflation and the Consumer Price Index

- Incomes

- Gross Domestic Product

- External Trade

- Population

- Arrivals and Departures

- Health

Inflation and the Consumer Price Index

What is price inflation and how is it measured? Price inflation is the change in the average prices of goods and services over time. The rate of price inflation is calculated from the change in the CPI, which is the official measure of the average change in the prices of goods and services paid by consumers. The CPI is estimated each quarter, i.e. once every three months, and the rate of price inflation is usually quoted on an annual basis; that is, comparing price changes over a 12-month period. Prices and the CPI tend to go up, but they can occasionally go down – which is known as price deflation.

The CPI is a statistical measure of the change in consumer prices on St Helena; an increase in the CPI means that, on average, prices have gone up since the last time they were measured, and a decrease in the CPI means that, on average, prices have fallen. The annual change in the CPI is called the annual inflation rate, and is the usual measure of the change in prices in an economy. The CPI is an average measure: if it goes up, it does not mean that all prices have gone up, and similarly, if it goes down, it does not mean that all prices have fallen.

Why do we measure inflation? An accurate measure of price inflation helps understand the extent and nature of the impact of price changes on the government, businesses, households and individuals. Inflation rates are often used in budgeting and accounting processes so that costs can be adjusted for the effect of price changes.

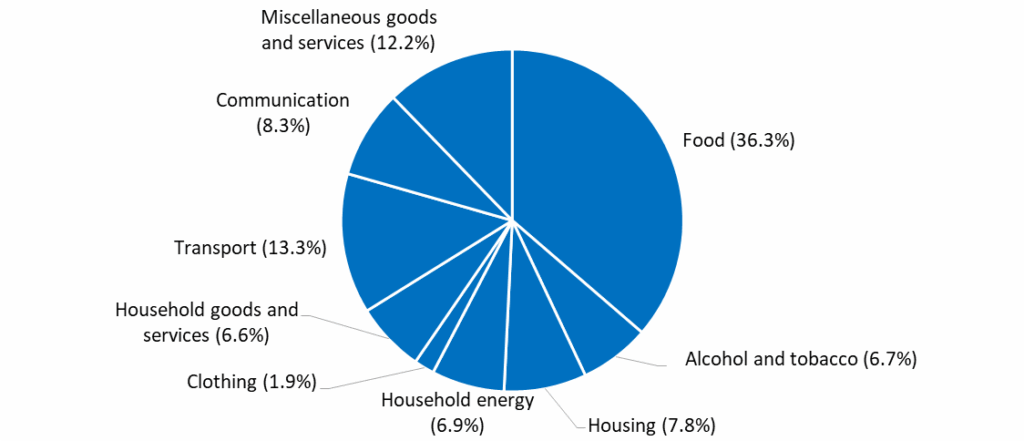

How is the CPI calculated? The basis for the CPI is the average weekly cost of goods and services purchased by households on St Helena for consumption, sometimes called the CPI ‘shopping basket’. Items which households purchase more of, such as food, have the biggest share of the CPI basket. The current CPI uses a basket from the latest Household Expenditure Survey in 2023; prices representing the groups of items in the basket are collected every quarter, and the price of the total basket is compared to the price in the baseline period, the third quarter of 2024. By convention, the value of the basket in the baseline period is scaled to 100, and the CPI values are quoted in relation to that baseline. For example, a CPI value of 120 means that average prices have increased by 20 per cent compared to those recorded in the baseline period.

Rebasing the Index. The Index was rebased in the third quarter of 2024, following the 2023 Household Expenditure Survey (HES) and subsequent analysis by the Statistics Office. The HES reviewed the composition of the average ‘shopping basket’ of goods and services purchased by households on St Helena, to make sure it reflects current spending habits. The Statistics Office has also reviewed the items that are used to represent each category of spending in the basket, to make sure they are also up to date and relevant. The rebased Index includes 205 categories of expenditure, within nine broader groupings; these broader groupings are unchanged from the previous Index. Within the broad groupings, the detailed categories of expenditure have been adjusted slightly to better align with international guidelines, and in particular they now only include expenditure related to household consumption, and not all expenditures. This has also made a change to the terminology necessary: the Index has been renamed the Consumer Price Index (CPI), rather than the Retail Price Index (RPI).

Composition of average household weekly expenditure (Q3 2024 CPI ‘Shopping Basket’)

What happens when items are not available? If an item of the ‘basket’ is not available then either the previous price will be carried forward from the previous quarter, or a suitable substitute item will be identified and an adjustment calculation made. Care is taken to ensure that this substitute item represents the item category and that it does not introduce error to the measurement of the CPI. An important principle is that price changes should reflect actual price increases and decreases, and not changes in the quality of items.

Incomes

Data source. Statistics on wages and incomes on St Helena are derived from a computerised database maintained by the Income Tax Office, which captures information about all wage earners whose details are submitted through the Pay-As-You-Earn (PAYE) system. There are some limitations when using this database as a source for estimating incomes; for example, informal income earned may not be declared; it is difficult to distinguish full-time and part-time workers and full-year and part-year incomes; and a small number of reported incomes may include second jobs or other sources of income.

Gross income (wages) from employment. The primary analysis in this Bulletin uses average gross incomes from employment, also referred to as wages. Income from investments (including employer pension schemes) and from self-employment, benefits, or the Basic Island Pension is excluded, as far as they can be identified. Incomes are gross, that is, before any tax is deducted, and all published estimates are rounded to the nearest £10 (calculations of constant price estimates are made on the unrounded estimates and growth rate calculations are made using the rounded estimates). Only incomes that are high enough to represent full-time employment from a 32.5 hour working week are included; this is a slight change in methodology, and has been reduced from 35 hours to ensure all incomes resulting from roughly 35 hours of work per week are included.

Median. The median is a measure of the average value of a set of numbers. It is the ‘middle number’ in a ranked list, the value at which exactly half the population has a smaller value and half has a higher value. It is preferred to the mean when estimating average incomes or wages, since it is less easily ‘skewed’ by a few individuals with relatively large incomes.

Mean. The mean is a measure of the average value of a set of numbers; it is derived by adding all the numbers together, and dividing by the number of values in the dataset. While it is the most common measure of the average for many applications, it can produce misleading results for estimating average incomes because it can be biased by small numbers of relatively high incomes.

Adjusting for inflation. Most of the average income estimates are adjusted for the impact of price inflation, using St Helena’s Retail Price Index to estimate relevant statistics in the latest year’s prices. Inflation-adjusted estimates are called ‘constant’ or ‘real’; unadjusted estimates are called ‘nominal’ or ‘current’. Inflation-adjustment makes comparisons over time more meaningful, since any change up or down shows whether a person has more or less purchasing power. For example, the median nominal gross income for 2013/14 was £7,780 per year. But prices were not the same in 2023/24 as they were in 2013/14; an employee would need to have earned £10,300 a year to buy the same amount of goods and services in 2023/24 that they could buy in 2013/14 with £7,780. So £10,300 is the average gross income in 2013/14 stated in 2023/24 prices.

Eliminating part-year and part-time incomes. A lower bound threshold is set to try to ensure that part-time or under-reported incomes are excluded from the analysis as far as possible; the threshold is set using the Minimum Wage for a 32.5 hour week (this is a slight change, from the previous threshold which used 35 hours). Incomes that were assessed for income tax using an allowance of half a year or less have also been excluded.

Exclusion of Technical Cooperation Officers from the analysis. Technical Cooperation Officers are persons employed by St Helena Government following international recruitment as a result of limited labour availability in particular occupations on the Island; in 2023/24, 92% of them were Managers, Professionals, Associate Professionals, or Technicians, and 95% of them worked in Public Administration (which includes the Police and various legal professions), Human Health and Social Work (which includes Doctors and Nurses), and Education (which includes Teachers). They are employed for a fixed period of time on internationally competitive pay scales and terms and conditions which differ from those recruited locally on St Helena. As such, their incomes are not typical and so are excluded from the main statistics on incomes.

Gross Domestic Product

Revisions: GDP estimation and measurement methods are complex and development of St Helena’s National Accounts is an ongoing programme of work. All published estimates should be considered provisional and subject to future revision as additional data sources become available and further improvements are made to the methodology.

Approach: There are three basic methods of compiling total GDP: the expenditure, income, and production (or output) approaches. Prior to 2016, St Helena published estimates based on the expenditure approach, and in 2016 a figure for 2014/15 was published based on the income approach. This Bulletin presents estimates based on the production approach. As far as practicable in a small economy with limited resources for compiling GDP statistics, the methods used aim to follow the international guidance published in the 2008 System of National Accounts by the United Nations.

GDP at basic prices: Estimates at basic prices are derived as the sum of the gross value added of companies and government consumption expenditure, plus the incomes of sole traders, and an estimate of the rental value derived by households from the owner-occupation of their homes. The valuation of the output of government has been made on a net basis, excluding an estimate of asset depreciation (this is common in other small countries). Taxes on production are small and have not generally been included, so the value of GDP at basic prices is roughly equivalent to factor cost.

GDP at market prices: To be consistent with the guidelines issued by the United Nations, GDP at market prices is derived by adding total indirect taxes on products and production (including customs duties and service taxes) to total GDP at basic prices, and subtracting regular government subsidies to companies (these subsidies are included in the sectoral breakdown of GDP at basic prices).

Inflation adjustment: Estimates are presented in both nominal and real terms, also referred to in this release as current prices and constant prices (constant prices are qualirelative to a particular year). Estimates in nominal terms will change due to both the effect of price changes and because of growth in the size of the economy. But changes in the size of the economy can only be measured using estimates expressed in real terms, adjusted for price inflation (i.e., using constant prices). Estimates in real terms have been calculated by applying the recommended method of using specific inflation estimates for each industrial grouping of economic activity, an improvement on past practice of using St Helena’s Retail Price Index.

Measurement issues: There are significant measurement difficulties in obtaining accurate source data for estimating GDP and related indicators for St Helena. Additionally the recommended measurement frameworks and concepts are not always well suited to measuring economic activity in small, aid-dependent economies. Estimates are very sensitive to timing issues and to recording or classification conventions, which while appropriate for larger economies may distort trends and levels in smaller countries. There are further measurement difficulties in calculating GNI; in particular, there are very limited data sources to estimate the income earned abroad by resident individuals and companies and the income earned on St Helena by non-resident individuals and companies.

Per capita estimates: For calculating per capita estimates of both GDP and GNI, the population total used is the average of the end of month on-Island population estimates for the period, as published on the St Helena Government website by the Statistics Office.

Currency conversion: For converting from St Helena Pounds (£) to United States Dollars ($) the average monthly spot rates published by the Bank of England have been used for each financial year.

Data sources: The primary sources that have been used to compile GDP and related measures include Income Tax returns, published company accounts, and population estimates published by the Statistics Office. Thanks are extended to all the companies and businesses that have responded to past Business Surveys, to the Income Tax Office for their cooperation and help in using the data from tax returns for this purpose, and to the Immigration Office for their help in using data on arrivals and departures to estimate the size of the population. Data confidentiality is maintained in accordance with the requirements of the 2000 Statistics Ordinance.

Technical advice and support: Compiling estimates of Gross Domestic Product and related National Accounts is a highly specialised task that has only been possible because of the technical advice and support provided by the Office of National Statistics (ONS) Methodology Advisory Service in the United Kingdom – thanks are especially due to Jim O’Donoghue and Robin Youll.

External Trade

Concepts and definitions: The compilation methodology for international trade statistics on St Helena uses the guidelines published by the United Nations Statistics Division. Generally, imports and exports are transactions involving the exchange of goods or services between residents and non-residents of St Helena. For goods, imports and exports are usually recorded whenever a commodity crosses St Helena’s boundaries, typically a border entry point, or a ‘bonded’ warehouse (a place where goods liable to import taxes are stored until those taxes are paid). For the purpose of St Helena’s import statistics, the date of customs duty assessment is usually taken to be a reasonable estimate of the date at which the commodity has effectively crossed the border. Since goods are counted as imported when they enter the domestic economy, goods imported into bonded warehouses are only counted when they are released from bond. Goods imported after being temporarily exported for repair are also not included. Similarly, machinery imported on a temporary basis, for example to support construction products, is not included, if it can be identified. This update focuses on the imports of goods but it should be noted that St Helena’s trade with other countries also includes imports and exports of services. Imports of services include medical treatment and training programmes abroad, communications services, and services delivered by persons visiting the Island but who do not live on St Helena. St Helena’s service exports include spending on St Helena by tourists and short-term visitors; estimates of this non-resident spending on St Helena are available in the detailed data file, here.

Data source: Statistics on the imports of goods are derived primarily from the administrative records resulting from the Customs process, particularly the legal requirement for a declaration to be made to the Customs authorities whenever goods are imported or exported. These declarations are stored in a computer system called ASYCUDA, managed by the Customs Office. Although the Statistics Office conducts a number of consistency checks to identify and correct valuation and classification errors, the data quality of statistics on international trade depends on the quality of information entered into the ASYCUDA system by importers and by Customs officials. The quality of the information collected by the Customs Office on the quantities of commodities imported does not currently permit the calculation of trade statistics on volumes or quantities.

Valuation method: Values are reported in ‘current’ prices, that is, the value recorded at the time of the customs transaction, without any adjustment for price inflation (i.e. the changes in prices of commodities over time). On St Helena, the value recorded by importers for the assessment of import taxes and duties is ‘free-on-board’ (or FOB), rather than inclusive of ‘cost, insurance and freight’ (or CIF); import statistics are therefore also based on the FOB valuation of goods. This means that St Helena’s import statistics are based on the invoice value paid by the importer in the country of purchase, and they do not include the costs of shipment, or any duties or taxes paid in that country. Goods purchased in foreign currencies are valued in Pounds based on the exchange rate used for the Customs transaction, rather than the exchange rate used by the importer when they purchased the goods. If the rate used for the Customs transaction is not known, the average monthy ‘spot’ rate published by the Bank of England is used.

Classification of commodities: Commodities are classified by importers on their customs declarations using an eight digit tariff code, which is based on the international six digit ‘Harmonised System’ classification maintained by the World Customs Organisation. In this report, and for the presentation of St Helena’s trade statistics generally, the Standard International Trade Classification is also used; this was developed for analytical purposes by the United Nations Statistics Division, while the Harmonised System is primarily designed for the administration of Customs systems. There are ‘correspondence tables’ between these two classification systems maintained by the United Nations, which enables St Helena’s trade statistics to be analysed and presented using either classification.

Frequency: The trade statistics in this update are presented by financial year, and the Statistics Office currently analyses the ASYCUDA database every year. However, data are computed by quarter, which can allow calculation of trade statistics by calendar year, or by quarter if required. Any analysis of quarterly import statistics should be made with care, however, since they can be affected by the timing of cargo shipments and other issues.

Population

Basic method: The number of people on St Helena in different categories of the population are estimated using the benchmark results from Population Censuses (the latest was conducted in 2021), records of birth and deaths maintained by the Customer Services Centre at the Post Office, and records of passenger arrivals and departures maintained by the Immigration Service of the Safety, Security and Home Affairs Portfolio. Essentially, the population estimate at the most recent census is increased by births and arrivals, and decreased by deaths and departures, with adjustments for changes to age over time.

Residents: Residents are classified as persons who are living (or intend to live) on the Island for six months or more; other arrivals are classified as visitors, regardless of whether they have St Helenian status or not. The six-month time period for visitors to St Helena reflects the distinction made in St Helenian Immigration legislation between short-term and long-term permits.

St Helenian: St Helenians are classified by their St Helenian status, as recorded by Immigration Officers.

Classification issues: There are instances when residence status changes (for example, a visitor stays longer than six months) or when St Helenian status changes (for example, a non-Saint Helenian resident is granted St Helenian status); these changes will typically only be incorporated in the population estimates when there is a corresponding immigration transaction. Immigration records may also not be precise for statistical purposes, for example, some St Helenians living or born abroad and arriving for a temporary visit may be registered using the nationality of their passport, rather than as a St Helenian. Whilst every effort is made to ensure that classifications for statistical purposes are correct, there is potential for error, and the population statistics presented in this bulletin should be treated as estimates.

Arrivals and Departures

Data source: Arrival and departure records maintained by the Immigration Office of the Safety, Security and Home Affairs Portfolio, supplemented by surveys conducted by staff in the Treasury, Infrastructure and Sustainable Development Portfolio.

Classification: Arrivals and departures are classified into purpose of visit or departure at points of entry to St Helena. Estimates are provisional, and may be revised in subsequent months.

Arrivals: Tourism/holiday includes short-term visitors or departures (i.e. less than six months) for tourism or holiday purposes, and it includes St Helenians making short-term visits to St Helena to see family and friends, both those that live permanently abroad and those who are away for a period of overseas employment. Day visitors arriving on cruise ships are not included in either arrivals or departures. Business and employment includes short-term and long-term arrivals who arrive for work purposes, including those employed by St Helena Government on contract (and their families). Returning residents are people who are returning to their normal place of residence (this excludes those returning for the purpose of business or employment, who are classed as business). It also includes people returning permanently from periods of overseas employment. Transit includes those for whom St Helena is not their final destination; it includes most arrivals by yacht and any people transiting to or from a ship via air.

Departures: The reason for leaving St Helena is categorised into tourism or holiday, medical treatment overseas (including persons accompanying patients), emigration or employment of St Helenians and their families (usually in the UK or on Ascension Island or the Falkland Islands), to return to a place of residence, or for other reasons (such as business, training, or transit).

Health

Underlying cause of death. These estimates are derived from the St Helena register of deaths. Conditions are stated on the death register in two parts: Part I lists the diseases or conditions directly relating to the death, in antecedent order (a, b and c), and Part II lists other significant conditions contributing to the death, but not related to the disease or condition causing it.

The St Helena death register includes all deaths that occur on St Helena; since 2018, deaths of residents that occur abroad (for example, during a medical referral overseas) may also be registered on St Helena, although this is not compulsory. Because of the relatively small numbers involved, deaths classified by underlying cause are grouped into decades (i.e. periods of ten years), rather than reported in single years.

For statistical purposes the International Statistical Classification of Disease and Related Health Problems (ICD-10) underlying cause of death codes are assigned to each death, using the World Health Organisation ICD-10 on-line browser and the ICD-10 mortality coding rules in Chapter 4 of Volume 2 of the ICD-10 manual. A freely available software coding application (‘Iris’) is used to help ensure that the complex ICD-10 mortality coding rules are followed; this is developed and maintained by the Iris Institute within the German Federal Institute for Drugs and Medical Devices, and is used in Europe and in the UK.

For tabulation and analysis purposes, underlying cause of death codes have been grouped according to the classification used by the World Health Organisation in their latest estimates of country-level deaths by cause for years 2000-2019, which can be found in Annex A of the WHO Global Health Estimates Technical Paper WHO/DDI/DNA/GHE/2020.2.

Life expectancy and healthy life expectancy. Life expectancy is an estimate of the average years lived after a specific age, based on the population and death rates prevalent for those that have died in the previous ten years (ten years is used for St Helena as the population is relatively small; typically, larger countries calculate life expectancy from deaths in the previous one or two years).

Healthy Life Expectancy is an estimate of the average years lived after a specific age in a very good, good, or fair state of health, as self-reported in the 2021 Census; additionally, all those in hospital or in the Community Care Centre on Census Night are assumed to be in a poor state of health. The methodology for calculating both life and healthy life expectancy is based on a standard life table, using a template provided by the UK Office for National Statistics.